XRechnung Software For Advertising Agencies - Simple, Fast and Legally Compliant

Electronic invoicing is becoming increasingly important in the digital transformation. Since November 2020, XRechnung has been mandatory in Germany for invoices to public sector clients.

Advertising agencies without public sector contracts have so far been able to avoid this issue. However, now is the time to check your own software and ensure that it meets the requirements of e-invoicing. From 2025, the e-invoicing obligation will be extended to all B2B business transactions.

This article provides comprehensive information on the options for creating a legally valid e-invoice, be it XRechnung or ZUGFeRD, the legal framework, exceptions and deadlines. We also introduce you to various methods for creating XRechnung invoices and present suitable software solutions that can help you to make your agency e-invoice-ready in good time.

Table of Content

E-Invoice - Key Points at a Glance

What Are the Advantages of XRechnung & ZUGFeRD?

Are There Exceptions to the Obligation to Issue E-Invoices?

What Are the Retention Periods for XRechnung & ZUGFeRD?

Which Software Is Used to Transmit XRechnung to Authorities?

How Are E-Invoices Handled in Other EU Countries?

How Do I Create an XRechnung? Software Solutions Compared

LEADING Job: XRechnung Software for Receiving, Processing, and Sending

Best XRechnung Software - Contact Us Now

E-Invoice - Key Points at a Glance

What Is an e-Invoice?

An e-invoice is a digital process in which invoice information is transmitted electronically, received automatically and processed further without media discontinuity. In contrast to previous digital invoices, such as PDFs, an e-invoice is a structured, machine-readable format that is created in accordance with CE standard EN 16931.

There are currently two common formats for e-invoices: the XRechnung and the ZUGFeRD file.

What Is an XRechnung?

This format consists exclusively of a structured XML data set that is machine-readable, but does not offer a visible invoice view (no logo, company CI, formatting, etc.). Since November 2020, invoices to federal, state and local authorities must be submitted in this format. However, it can also be used in the B2B sector as part of the e-invoicing obligation that will apply from 1 January 2025.

What Is a ZUGFeRD File?

This combination of PDF and embedded XML data record offers the advantage that both machine-readable processing and a visible invoice view are available to the recipient. This format is particularly useful if recipients are not yet able to process e-invoices or do not have access to specific e-invoicing systems as private individuals. The ZUGFeRD format only applies in version 2.2.0 in the XRechnung profile for invoices to public institutions. For the most part, it is only used in the private sector, where it offers flexibility by combining a structured data set with a readable PDF document.

The integration of e-invoicing into existing systems can be a challenge at first, but offers considerable advantages in terms of efficiency and cost reduction in the long term.

What Are the Advantages of XRechnung & ZUGFeRD?

- Automation: The structured data form enables automatic processing, which reduces manual effort and processing time.

- Cost savings: Automation and the elimination of paper, printing and postage costs reduce administrative costs.

Faster payment processing: The more efficient processing shortens the time to payment and improves cash flow. - Legal compliance: XRechnung & ZUGFeRD fulfil all legal requirements and standards, in particular the European standard EN 16931.

- Environmentally friendly: Switching to electronic invoices reduces paper consumption and carbon footprint, contributing to a more environmentally friendly business practice.

The choice between XRechnung and ZUGFeRD depends on a company's specific requirements and business relationships. While XRechnung is mandatory for public clients, ZUGFeRD offers a flexible solution for the private sector.

Obligation to Issue E-Invoices: Transition Regulations, Deadlines, and the Use of XRechnung Software in Germany

The obligation to use XRechnung for invoices to public institutions has already been in force since 2020. What is new from 1 January 2025 is the fundamental obligation to issue invoices electronically, also in the B2B sector. However, due to the expected high implementation costs for companies, the legislator has provided generous transitional provisions for the years 2025 to 2027.

From 2025, companies must be able to receive e-invoices, but invoices can be issued in paper form until the end of 2026 if the recipient agrees. For invoice issuers with a maximum turnover of 800,000 euros in the previous year, this transitional regulation will continue to apply until the end of 2027.

However, it is important that companies familiarise themselves with the new requirements at an early stage and adapt their invoicing processes accordingly in order to be fully compliant from 2028.

Are There Exceptions to the Obligation to Issue E-Invoices?

There is an exception for low-value invoices, under which no XRechnung has to be issued. A low-value invoice exists if the total amount of the invoice does not exceed 250 Euros (including VAT). Less stringent regulations apply to such invoices and they do not necessarily have to be issued in XRechnung or ZUGFeRD format.

What Are the Retention Periods for XRechnung & ZUGFeRD?

The standard retention period of 10 years applies to XRechnung. It must not be possible to change the data carrier retrospectively. The saved format must be machine-readable at all times. Paper printouts are not accepted for audits.

Which Software Is Used to Transmit XRechnung to Authorities?

In Germany, there is no standardised platform for uploading XRechnung to all public clients. Here are some of the platforms that are used here:

- Zentrale Rechnungseingangsplattform des Bundes (ZRE): This platform is used for the submission of invoices to federal authorities.

- OZG-RE: The platform for implementing the Online Access Act for invoices to federal authorities.

- State-specific platforms: Many federal states have set up their own invoice receipt platforms or portals to receive XRechnung. Examples include thes BayernPortal, the Niedersachsen-Portal and others.

How Are E-Invoices Handled in Other EU Countries?

- Austria: In Austria, there is the Electronic Invoice to the Federal Government (ERB) platform, which suppliers must use to submit their invoices to federal authorities.

- Italy: In Italy, the use of the Sistema di Interscambio (SdI) platform is mandatory for submitting electronic invoices to contracting authorities and in the B2B sector.

- Spain: In Spain, electronic invoices must be submitted via the FACe platform if they are addressed to contracting authorities.

- France: France has set up the Chorus Pro platform for the submission of invoices to contracting authorities.

- Czech Republic: No central platform or mandatory regulation for electronic invoices.

- Romania: Mandatory use of the e-Factura platform for contracting authorities and certain B2B transactions.

- Poland: Krajowy System e-Faktur (KSeF), mandatory for B2G and soon for B2B.

- Hungary: Online Számla platform, mandatory for certain domestic transactions.

Companies operating in these countries should familiarise themselves with the respective national regulations and use the relevant platforms to meet the legal requirements.

How Do I Create an XRechnung? Software Solutions Compared

To create XRechnung and ZUGFeRD invoices, there are various software solutions and tools that are available both commercially and as open source. Here are some options:

AddOns for Existing ERP Systems

The most common methods include add-ons for existing ERP systems such as SAP, Excel and Dynamics 365 Business Central, which can be seamlessly integrated into the existing software. These add-ons make it easier to create XRechnung directly from the familiar programs and offer additional functions for automation and optimisation.

Online Generators

Online generators are a practical solution for smaller companies or occasional users. These web-based tools make it quick and easy to create an XRechnung without the need to install software. Examples include Xero and QuickBooks Online.

Open Source Tools

Open source tools are cost-saving and flexibly customisable. They do not require licence fees and are supported by a developer community. Examples include Mustangproject for ZUGFeRD- and XRechnung-compatible invoices and InvoicePlane as a self-hosted solution.

Specialised Agency Software

A particularly advantageous approach for agencies is the use of specialised agency software. These software solutions offer comprehensive functions for creating, managing and transferring XRechnung and are ideal for agencies with a high volume of invoices. They enable automated invoicing, which saves time and effort. They also often offer integrated project and time tracking features, which is particularly useful for agencies with many ongoing projects and different billing methods.

Other benefits include seamless integration with accounting and CRM systems, making overall administration more efficient and error resistant. Using such specialised software can increase efficiency, minimise errors and ensure compliance with legal requirements.

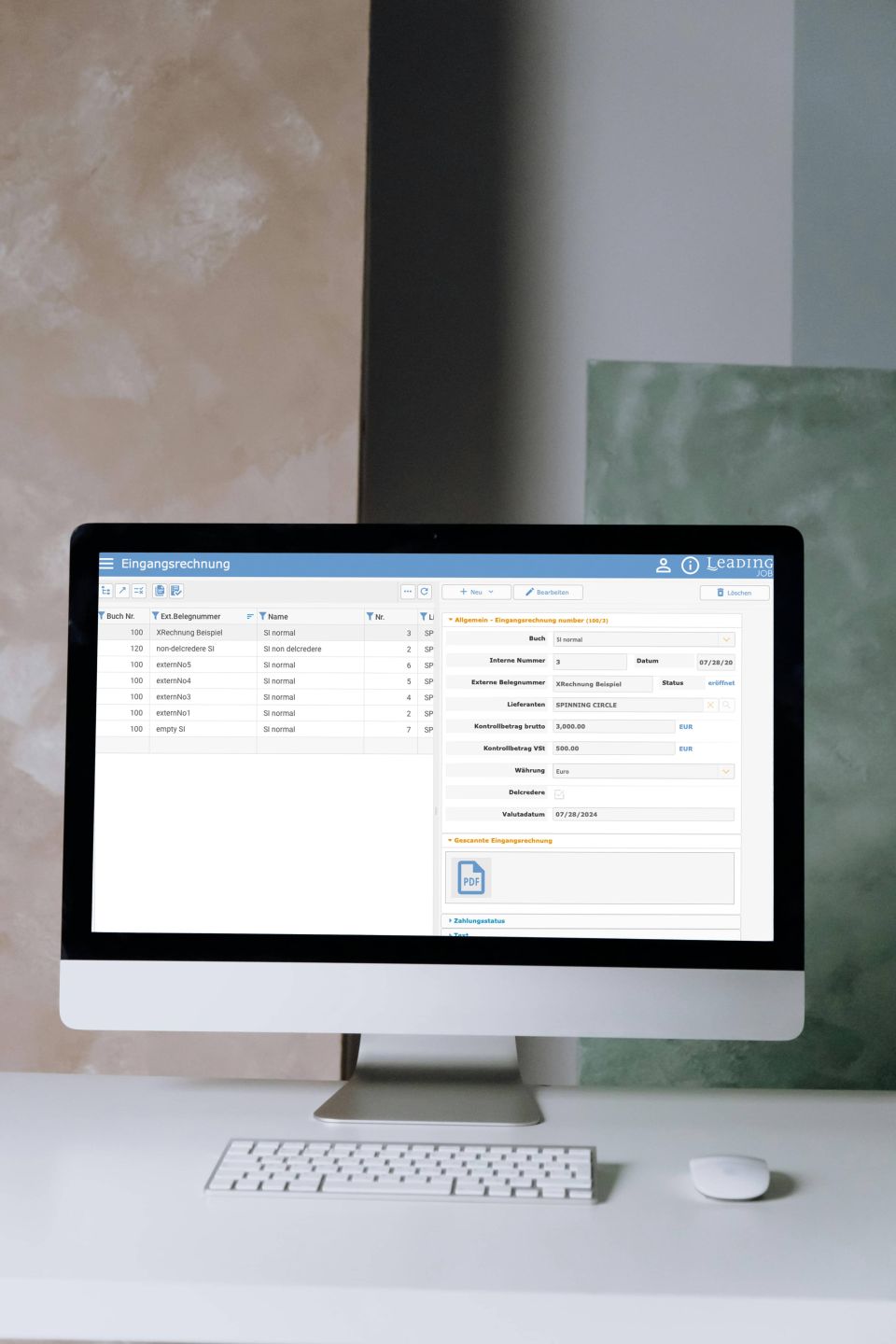

LEADING Job: XRechnung Software for Receiving, Processing, and Sending

Does it all sound very complicated and incredibly time-consuming to implement? It doesn't have to be!

With the LEADING Job agency software, you are ideally prepared for the upcoming e-invoicing obligation in Germany. This software not only ensures compliance with all legal requirements, but also maximises the benefits of digital invoicing. LEADING Job supports common formats such as XRechnung and ZUGFeRD and enables smooth processing and creation of e-invoices.

Create e-Invoices

In LEADING Job, electronic invoices can be created by selecting the appropriate electronic invoicing system in the 'Electronic invoice' field in the client's master data. For example, if you select XRechnung or ZUGFeRD, LEADING Job automatically creates electronic copies of your client invoices for this client.

In addition to XRechnung & ZUGFeRD, LEADING Job supports a variety of e-invoice formats for international use. These include the OB10 standard, which is used worldwide, particularly in Europe and North America, as well as eSLOG and ebInvoice, which were developed specifically for Switzerland. The NAVExportHU format is supported for Hungary. The Romanian formats E-Factura RO_CIUS UBL and CII are also covered.

Transmitting e-Invoices

The generated XML files can then be exported to a folder on your file system. From there, the files can be uploaded to your clients' electronic invoice inbox or sent by e-mail.

Receive and Process e-Invoices

The new legal regulations on e-invoicing do not define a specific transmission channel. This means that a simple e-mail inbox is sufficient to receive XRechnung. With LEADING Job, you have various options for receiving and processing e-invoices:

- Manual entry: you can already manually transfer data from electronic invoices to your systems. This applies both to ZUGFeRD invoices, which are available as PDFs with an embedded XML data record, and to XRechnung invoices, for which tools are available that read and display the XML.

- New feature in 2025: Automatic import of XRechnung & ZUGFeRD. From the start of 2025, LEADING Job will offer a simple solution for importing e-invoices. The new function automatically creates an incoming invoice entry by processing the XML and generating the invoice header. The assignment to jobs and positions is carried out as usual.

For a detailed visual guide, please refer to this tutorial video, which demonstrates each step of the e-invoice import process in LEADING Job:

The switch to electronic invoicing and the use of ZUGFeRD-ready and XRechnung software is essential for companies. Take care of the implementation of a suitable software solution such as LEADING Job as soon as possible in order to future-proof your business processes and successfully complete the switch to electronic invoicing in Germany within the transition period by 2028 at the latest. LEADING Job not only ensures compliance with legal requirements, but also maximises your operational efficiency and competitiveness.

Best XRechnung Software - Contact Us Now

Our experts will be happy to provide you with further information and personalised advice. Contact us today and find out how you can optimise your e-invoicing processes.